Time for mortgage REITs? Chimera Investment Corp (CIM) in focus. Portfolio update February.

Looking in 34, investing with Hugo Engels.

Introduction,

Dear reader, in this edition of “Looking in” we are going to focus on mortgage REITs. This is the reason why we have Chimera Investment Corp (CIM) in focus. Of course there is also the portfolio update.

Let’s first focus on the current market developments regarding the portfolio.

Commodities:

Let’s start with commodities, the strong start of commodities this year have faded somewhat. Probably because of some signs of a slowing economy in the US. Sadly, PGMs have retreated with both palladium and platinum falling under the 1000 USD / Oz. Looking at the latest earnings of Sibanye Stillwater Ltd. (SBSW) they really need the price of PGMs to normalize. Until then it’s difficult for them to make any money. Nothing else to do than to wait. Gold is still holding on tough; this metal is not really driven on economic growth expectations. Oil has been surprisingly resilient.

Year to date chart: HG1 (copper), XUD/USD (gold), CO1 (Brent) % performance

Interesting conference call for Q4 2024 (2-2025) earnings Sandstorm Gold (SAND). They have reduced debt in 2023 & 2024, now they intent to buy back shares aggressively in the market (well, that’s what they say anyway). They also have quite some additional gold royalties coming online from now to the end of the decade. Don’t really understand why they trade at such a discount next to their peers. Especially after reducing the debt the last two years.

Equities:

I have not much to add on this front, I finalized my allocation to the credit part of the real-estate market. I also sold my luxury brands allocation. Although I still believe in the investment thesis, I felt it was time to move on and take the gains. I also want some more focus in the portfolio. I did have a thought I wanted to share.

The shift towards a more positive momentum for European stocks has continued. This change in sentiment has me feeling there could be some more acquisitions from private equity on the horizon. I was actually surprised in 2024 that there was not that much acquisition activity in continental Europe. There were loads of quality businesses that were trading at a discount. In retrospect, what I think could be one of the culprits; Private equity is in the business of managing assets and earning fees, they need to sell their funds. So, they are influenced by what is in favor. It will be hard to sell clients a fund that is chuck full of businesses in a region you hear experts and pundits &%@! on. Moreover, with the relative high dollar in 2024 you would expect US professional allocators to be more opportunistic. Let’s see….

Talking about acquisitions, Prosus (PRX) has made an offer to acquire Just Eat (Takeaway TKWY). From the PRX side this is a logical acquisition. TKWY trades at a strong discount to its peers. They also are the number one in the Netherlands and Germany. TKWY also moved back to being cash flow positive. This after a period of high investments and expansion (in part financed with the IPO). PRX already has assets in the food delivering industry, so the synergies proposition makes sense. PRX offers 4,1 B EUR. This is about ~ 1* P/B and 1,1* P/S. I was surprised to see that the management of TKWY is all for this deal. Feels like a bargain for PRX, and I would imagine that there is plenty disappointed shareholder. A look at the chart of TKWY shows why. The reason I highlighted this is because it hits close to home, I had still a Call (L) and Put (S) option on TKWY. Moreover, it is also a good example of a situation where equity holders were taken for a ride. Management had not signaled any intention to be looking for a sale. Moreover, suddenly they are all for selling the company at a stock price they only a few months ago deemed ridiculously low. The risk that an undervalued stock gets taken out is always there. From a merger arbitration angle this could be an interesting investment, it would not be inconceivable that the TKWY shareholders will demand a higher price. PRX has ample cash to bump up the price.

5-years chart: TKWY Hist. price

Next, the mortgage REIT.

So, with that out of the way lets move on to the mortgage REIT. I have been interested in real-estate the last 2-years. In principle real-estate has inherent inflation resilience, steady long-term returns and allocate a lot in the form of dividend. With the latter giving constant optionality to the portfolio. These are all aspects that sit well with the kind of investor I am. Only, there is one important catch, you want to buy into real-estate in a period of reasonable low valuation. So, when the FED and ECB started raising rates my attention went to this sector. I felt patience was important together with a highly selective approach. The main investments I made were Wereldhave (WHA), Assura PLC (AGR), PRS REIT PLC (PRSR). I did not find a convincing investment in the US, I felt valuations were still too high, except for office but well……..Next to these single stock names I also hold the VanEck Global Real Estate UCITS ETF with covers the broad sector.

During my investigation into the sector, I came across the mortgage REIT. This is a subsector of the REIT world. they are similar businesses like conventional REITs only their focus is on the credit part of the real-estate sector. Looking at these businesses it seemed some had a hard time. Valuations were depressed and if you look at the recent earnings you would get the urge to run without looking back. This in retrospect was not so weird, the FED raised rates aggressively and this made the value of their loan book come down. Moreover, it also brought valuations of the entire real-estate sector down, what consequently muted activity in the space. Now, it is vital to note that there are vast differences in the kind of loans they can hold. These range from low-risk mortgages like Fannie Mae & Freddie Mac to hard money bridge loans. The same can be said for the balance sheet, this can be conservative or highly leveraged. All aspects to keep note of.

Anyway, my conclusion was that there had to be some value between the carnage. If I recollect correctly, I ran a screen looking for a less leveraged REIT that also had high dividend and reasonable size. There I found Rithm Capital Corp. (RITM) (for more details Looking in Nr. 16). Being a shareholder of RITM has taught me a lot about the mortgage REIT space. Following RITM and the REIT sector has brought me to the conclusion that this is a good moment to allocate more to mortgage REITs. I feel they can be a strong addition to my income/ carry focus for the portfolio, with the potential to create both strong dividend and total return.

At this moment in time my preference has shifted to the credit side above the equity side of investing in real-estate. In the chart beneath, you can see the spread in performance between the VanEck real-estate ETF and the VanEck mortgage REIT ETF. Also, clearly when the mortgage rate rises the mortgage REIT ETF falls.

10-years chart: 30 Y US mortgage rate & TRET & MORT % performance

Now, let’s look at how mortgage REITs performed the last decade. The following two chart are the VanEck ETF Trust - VanEck Mortgage REIT Income ETF (MORT). The first chart is the ETF dividend adjusted and the second chart is without dividend.

10-years chart: MORT Hist. price 250 D SMA (with dividend)

10-years chart: MORT Hist. price 250 D SMA (without dividend)

What can we conclude looking at these two chart? The fact that these stocks give out big dividend is not a sure path to riches. As a caveat, history is no guarantee for the future, but if we would take history as any guide, holding mortgage REITs throughout the entire cycle has underperformed. My feeling is that you need to buy them at a strong discount. It’s a little like buying a bond at a strong discount to par. These opportunities will not arise on the top of the cycle. No, you will have to take the plunge when they are facing headwind, and they are not featured in any podcasts, articles and publications.

At the moment, fixed income is out of favor and if there is any talk about it. The subject is US treasuries, private lending and BDCs. From that perspective we are on the right track. Moreover, I feel these assets trade at a perpetual discount because there is still post-traumatic stress from the Great Financial Crisis (the whole CDOs story). The fact that REITs need to pay out 90 % of their earnings creates a constant cashflow that you are free to allocate to your current favored market opportunities.

So, why invest in mortgage REITs now?

Let me explain my thinking. First let’s take a look at the yield curve.

Yield curve, US treasury rates (Feb. 2024, Aug. 2024 & Feb. 2025)

Here is some theory on how I think it would work. I would argue the mortgage REITs have had a hard time when rates risen. In the US it is very common to have a 30-year mortgage, when the Fed raised rates in 2022 homeowners were incentiviced to keep with the mortgage they have. This dampened new loan and mortgage origination. This is normally a great source of income for the mortgage REITs. Next to that, because rates risen the loan book falls in value, similar to a bond. Then on top of that, the value had fallen for many real-estate objects, this also has a negative effect on the balance sheet.

Fast forward to current times. Clearly the yield curve is steepened, this again lowers the value of the loan book, but it is also a favorable yield curve for mortgage REITs. All this difficulty has pushed valuations down right at the moment things are stabilizing. Moreover, real-estate value in aggreged has risen in the US and the economy is doing fine. As a result, and due to the passage of time, consumers and businesses have adjusted to the higher yield environment.

What I find in most current result presentation is optimism for the future. This is in many cases backed up by large share repurchasing programs and continuation of the dividend.

I have in total 4,9 % of the total portfolio allocated to mortgage REITs. I hold RITM & CIM as a more general exposure to the sector. Next to that I hold RC & SACH* who are focused on specialty finance in the real-estate sector *(Looking in Nr. 31). I allocated a large part of the BDC I exited and reallocated the funds towards the mortgage RIETs. So, let’s take a deeper look at one of these mortgager REITs.

Stock in focus: Chimera Investment Corp (CIM)

1-years chart: CIM Hist. price

Fundamentals:

Chimera Investment Corp (CIM).

CIM is a Small-Cap mortgage REIT that operates in the US. They focus on the residential sector, with 85 % in residential mortgage loans. They purchase these loans from banks, government agencies and other non-bank financial organizations. Subsequentially, they securitize these loans and retain the loans they favor, mostly the subordinate RMBS and sell the rest. By adding leverage to the spreads, they juice there returns. The sheet from there Q4 2024 earnings shows their allocation.

The bulk of their portfolio is focused on holding mortgagees for the acquisition of houses where people live in. They have a smaller part (8 %) non-Agency mortgages and some agency MBS (Mortgage-Backed Securities).

All with all this is not so special only in contrast to some other Mortgage REITs they don’t just stick to agency mortgages (backed by Fannie Mae, Freddie Mac, or Ginnie Mae). The composition of the loan book creates the risk dynamic of the mortgage REIT. What it comes down to is that there are 2 levers they can pull:

1 The leverage (amount & terms of the leverage).

2 The risk (repayment risk, interest rate risk, default risk, duration risk & Hedging practices).

In my opinion CIM finds itself on the middle periphery from a risk perspective. With the somewhat hybrid approach it has on the allocation side. It can be more flexible and take more risk reward accretive allocation decisions, depending on market opportunities.

The reason that I chose CIM? Well, I wanted to add a mortgage REIT with a somewhat middle of the road profile and relative lower leverage. I also wanted a focus on the residential part of the loan market. A sufficient balance sheet should give more optionality and flexibilities. This will set them up to take advantage when a more positive climate for mortgage REITs will arise. If we look at the scatter plot below, we see debt to equity of 400 %. This is more or less in the middle of the pack, but with a low valuation if we look at price to book (P/B). Next to that we can also read in the lates earning release their HPI* updated Loan to Value is 43 % *(HPI: adjusted with the rise in value of the assets the loan is linked to).

Scatter plot: mortgage REITs T debt/ Equity and P/B

In the next scatter plot we see that CIM pays a very average dividend for a mortgage REIT and has a medium size when it comes to market Cap. I like to focus on the second teer when it comes to size. I feel there is more upside to be found for a stock picker in contrast to the evergreen names. You do need sufficient size to have competitive access to capital, so the smallest names I feel are in a disadvantage regarding this aspect.

Scatter plot: mortgage REITs dividend Yield (NTM), market Cap

I also wanted a stock with a strong discount to book value. It’s my believe that a large part of the opportunity in mortgage REITs currently is the discount on the assets. Moreover, it also feels like a necessity as a starting point. When we look at CIM we see they trade near -2 standard deviations from the last 20-years mean. Where we can also see that the 10 -years period post Great Financial Crisis until the Covid crash they always traded near 1 times book. I know that Price to Book (P/B) is a crude tool only for banks and financial institutions I always found it useful. Moreover, a low stock price can incentivize the REIT to purchase back shares.

10-years chart: CIM P/B (LTM)

If we look at the stock performance, the stock has underperformed the broad mortgage REIT ETF the last year. From 2016 to 2020 it outperformed a lot, same after the covid crash. To be clear the chart is dividend adjusted, if we would look at the charts without the dividend the picture would be far more dramatic.

10-years chart: CIM next to MORT & REM (Mortgage sector ETFs) % performance

10-years chart: CIM & MORT (Mortgage sector ETF) Hist. price, 250 D SMA, P/B

In my opinion CIM trades at a strong discount even though residential is one of the better preforming parts of the real-estate sector. CIM is fully focused on residential. To diversify further in this sector, they also did an interesting acquisition in 2024.

Palisades Group & management.

In the last quarter of 2024 CIM has acquired Palisades for a 30 M USD payment and an optional earn-out of an additional 20 M USD. With this asset they mean to diversify their offering and enter the loan origination market. Palisades originates (creates) loans, advising and has a evaluation fintech tool. It is a relatively small acquisition that will widen their scope in credit solutions and enters them into the origination business.

CIM has been around since 2007, nice year to start a mortgage REIT, just on the gasp of the Great Financial Crisis. The management has a relative short tenure with CIM. They don’t have a very significant ownership in CIM only they have made some insider purchases.

Let’s wrap it up.

I don’t think CIM stands out very much next to their mortgage REIT peers. It’s funny that this is the reason I added them, I wanted something simple. With RITM, SACH and RC I already have plenty idiosyncratic exposure.

It is my believe that the sector is in a good spot to recover from the last two years. I also don’t see a very clear reason why they underperformed the market. I listen to quite some earnings calls from different mortgage REITs and came across more or less the same story with all of them. Also, in aggregate, what came across with me is a feeling of recovery in the space. What I like about CIM is that it is relatively simple, they focus on residential in the US. They trade with a strong discount. For this investment to have a good return they only need to get back halfway in valuation and continue with a strong dividend (something like ~ 9 % on cost). The high dividend and the asset backed nature of the mortgage REIT gives me some cushion if things turn sourer. There is no way for them not to be influents by interest rates and broad economic developments. Still, from this onset I like this mortgage REIT investment theme. My allocation to CIM is a large part of this, fingers crossed.

Stock picking portfolio:

Notes:

Sold: KER, WSE

Added: MRK, RC, ICAD

*Small write up.

My Daughters portfolio:

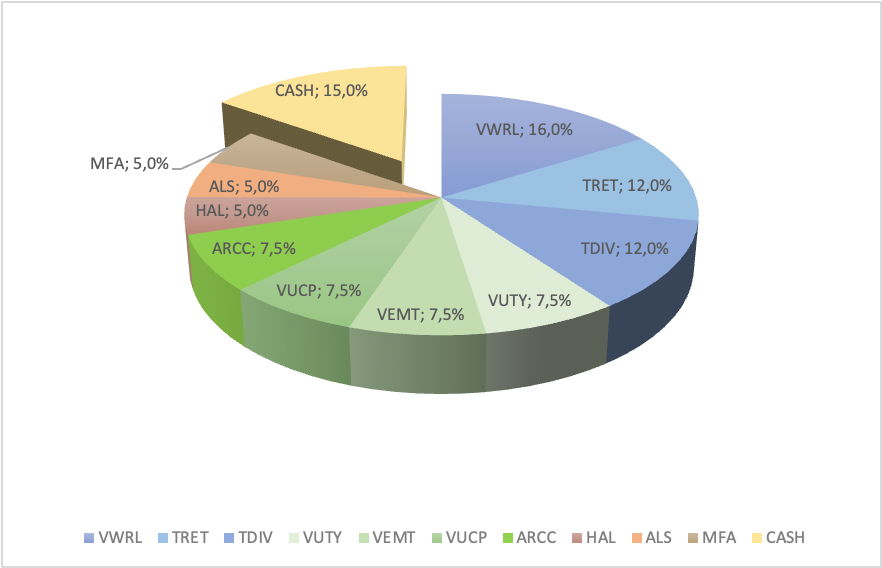

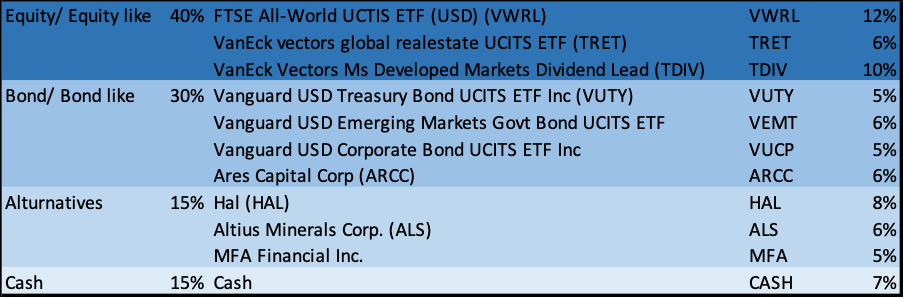

No changes to my daughter’s portfolio. Since inception the return has been 22,30 % (24 February 2025) after cost (Start 13 Okt. 2022). I don’t make many adjustments to the portfolio. It is meant as a set it and forget it portfolio, that if someone would be so inclined is easy to replicate in some form or manner (no investment advice).

Target:

Actually:

That was it for: Looking in Nr. 34.

I hope you enjoyed Nr. 34, please consider signing up for Hugo’s Substack. I can give you already one good reason to do so, it’s for free, what else you want, right?

If you have any comments or questions, please feel free to contact me, please share, like and subscribe. Sincerely,

Hugo Engels.

About the letter:

Dear reader, I’ve decided to start a letter on my investing process. I’m not a professional trader or investor and I hold no licenses or registrations. This letter can never be viewed as investment advice and the expressions and opinions that are written are mainly for entertainment purposes only.

Through this letter I want to evolve my own investment process and maybe give the reader an interesting prospective of a retail trader who enjoys markets and investing. If you are a starting investor who wants to go beyond the passive index fund, buy and hold strategy and would like to construct a more personal portfolio based on fundamentals this could by a nice letter for you to follow. Of course, any other reader would be more than welcome, and I would also love to have feedback. This is first of all a learning process for me.

In this letter I want to give my personal view on markets and investment processes. It will be from a European perspective with a clear value orientated focus. With an extra focus on The Netherlands. Hope you enjoy,

Hugo Engels