Brunel International NV (BRNL) in focus. Portfolio update January.

Looking in 33, investing with Hugo Engels.

Introduction,

We have made it through the first month of the year. Overall, it has been a good first month for the portfolio. We have seen already some volatility, and we find ourselves at the onset of the earnings season. This is always a nice moment to see what is happening at the companies I own and the ones I’m looking at.

Last weekend US president Trump has started to implement his tariffs “strategy”. What this will mean, we don’t know, seeing the market’s reaction on Monday (3rd February) we can state that the market had not yet priced in his aggressive tariffs. Honestly, what to expect of all this is difficult. Clearly it will not help non-US companies in their operations within the US. Moreover, it will also hit US companies when the tariffs boomerang back. Trying to front run these tariffs is probably a fool arrant, maybe it is better to just focus on quality businesses and long-term trends. Next to the economic ramifications flowing from the tariffs we also don’t know how long they will stay and if there are more coming. This uncertainty can create some opportunity in volatility.

Inflation in the US has been sticky, in Europe growth is stagnating and this has subdued inflation in the Euro zone. The ECB is still on the rate lowering trajectory, but I feel they can only go so far as long as the US is not moving down with them. I also question if the large structural problems in the Euro-zone can be overcome by moving rates down a few percentile points. This all does not seem to be positive, only valuations have been depressed already for quite a while, in regard to Europe domiciled companies to be clear. I do see a ray of light with the renewed realization that the EU has economic problems. It seems this subject has moved to the top of the agenda in Brussels. It is getting time to get serious about stimulating the broad EU economy with sensible policies.

The portfolio should have some insolation to rising inflation, there is a strong focus on equity and commodities. I feel 2025 will again be a roller-coaster ride.

I feel there can be some opportunities within the renewable space, this sector has had a though couple of years. Moreover, with the new US president it seems to only get worse. Still there can be valuable companies in this space that get rerated down with the total sector. On a longer timeline the energy transition is the future.

Luxury brands still seem interesting to me, and I want to raise my exposure. I sold my BDCs, I feel private credit is overcrowded and it’s time to move on. I have been adding to mortgage REITs to finalize my real-estate allocation.

Still, the plan for 2025 is to focus on underappreciated quality businesses. Just a small reminder. The investment sphere represents my investment style:

Stock in focus: Brunel International NV (BRNL)

1-years chart: BRNL Hist. price

Fundamentals:

Brunel International NV (BRNL) is a Dutch Small-Cap company (~ 470 M EUR) operating in the employment service. They focus on supplying high skilled operators in engineering, finance and IT. This especially in the materials and energy sector.

The employment sector is a sector that I have little allocation to. I looked at the sector in the past and always found it to be a bad risk reward proposition. It’s a sector with low margins (~ 2 / 3 % EBIT margin). Where scale seems to be the strongest competitive aspect. It’s a cyclical business where even in the good years the returns are still meager.

So, why invest in BRNL? Well, they are an interesting niche player in sectors with a tailwind. In an era that makes people want a career as influencer, being an engineer is not the most popular choice, especially in a ‘boomer’ sectors like mining or energy. These sectors are very depended on professional. Moreover, experience and high education are a necessity in this work force. Next to that, the workloads is in some cases very uneven. Many of these industries are cyclical.

A specialized employment provider can create great value in this sector. And this is precisely what BRNL has been doing the last 40 years. Founded in 1975 by Jan Brand. In 1997 they had there IPO and managed to grow into a world player with offices worldwide. The current CEO is Peter de Laat (started in Okt. 2024). With projects and engineering getting more and more complex the market for this kind of technical expertise will be utilized in a more flexible and hybrid model.

Slide Q3 2024 investors presentation

The largest part of the revenue comes from the Netherlands and the DACH region, around one third. Now, in all likelihood, it did not go unnoticed to the reader that Germany is not doing so well in their industry sector (especially the car making industry). The soft demand in the EU industrial sector has been a headwind as of late. And this is what I feel also has had its effect on the stock price the last years. Markets tend to over extrapolate, when things are bad, they get priced for terrible. Yes, they focus on cyclical sectors, but it is my believe that even though the cycle can be in a downturn I feel the secular trend behind most of these sectors is quite strong. Moreover, experienced operators in these fields are a valuable commodity.

I actually had BRNL on my watchlist for quite a while. When I saw the stock price fall, I believed it was a good moment to open the position. I would not be surprised to see the price fall further, so I also written a call to give me a small cushion. Now, what also makes BRNL interesting is the valuation, it is trading cheap in my opinion. So, let’s look at some fundamentals. When we look at some crude merit, we see BRNL trade low relative its resent history.

3-years chart: BRNL P/E, P/B, P/S & P/GP

But in contrast it trades rather high P/S multiple when compared to some peers (some that are much larger liker MAN & RAND). BRNL does have superior margins.

Scatter plot: BRNL, MAN, ALFRE, SDG EBIT M % & P/S (Country Sec R)

The sector as a whole has had a difficult period, or maybe you should say a less good period. During and after the covid pandemic there where many dislocations in the employment market. It seemed that some sectors had a very hard time hiring personal. Now, these environments have been good for the employment service. Coming of this high, things have normalized. Looking at the EBIT the last 20 years gives the impression this is a declining business, but this gives a wrong signal. I feel BRNL is positioned for positive growth in the medium upcoming period. Moreover, the deep recession that was expected in 2022 & 2023 has never materialized (well, as of yet).

Optically BRNL is not the cheapest stock in the sector, but it does offer way more quality. As I mentioned it is a low margin business in general, that is depended on the economic cycle.

20-years chart: BRNL EBIT, Hist price, EBIT M %, EBITDA Ets Avg, EBIT CAGR (5Y)

Look at the chart above, they managed to reach a 3,95 % mean EBIT margin over the last 20 years. This is quite high for the market they operate within. What is worrisome is that they did not grow the absolute EBIT number over the last 20-years. This I think will change in the short-term future; I feel the number of engineers the world needs will only rise. And with a growing pressure on immigration and free movement of labor the supply in workers will reduce. In the sectors they operate in, you need experienced talented professionals. Together with rising labor costs you want to use these professionals in an optimal way and only when you need them. All these trends will benefit BRNL in my opinion and this is what I think sets BRNL apart.

When we look at the balance sheet, we see a very healthy company with about 0,9* Net debt/ EBITDA.

10-years chart: BRNL Cash/ STI, EBITDA, Int Ex, Alt Z Sc, total debt

Next to that they also pay a nice dividend, only the payout ratio has been on the high side.

10-years chart: BRNL Div yield, Payout Ratio, CARG Div (5Y), US 10 Y yield

To wrap this up,

BRNL is a company with some quality aspects to it. Next to that, it’s not really expensive. I like the focus they have, and I can see strong opportunities for them ahead. Will they manage to capitalize on these opportunities need to be seen. I feel its detrimental they focus on their nice, I don’t see a way they can create competitive advantage in the general employment sector with their reasonable small size. Now, the good thing is I don’t see any signs management is straying of the path they have been following for already so long. Although it’s a cyclical business, it is also somewhat sticky. If employees are happy with the arrangement, they tend to stay loyal. Same can be said about businesses that hire them, if you chose for an operator like BRNL switching is a risk and a hustle.

From a higher level. What it comes down to; this is just another angle to invest in the commodity upcycle (super cycle) and the energy transition. It is a good company for a very reasonable price that pays a nice dividend. Combining it with some option selling makes this a nice total return.

Stock picking portfolio:

Notes:

Sold: LNTH, AFX, MONC, SAR

Added: TRIG, CIM, DUKE, KER

*Small write up.

My Daughters portfolio:

What a weird picture right? Well, I asked Copilot to make an image that represents my daughter’s portfolio, after a few tweaks this is what it came up with. Don’t know if this is an ominous or a positive sign. Let’s just assume the latter.

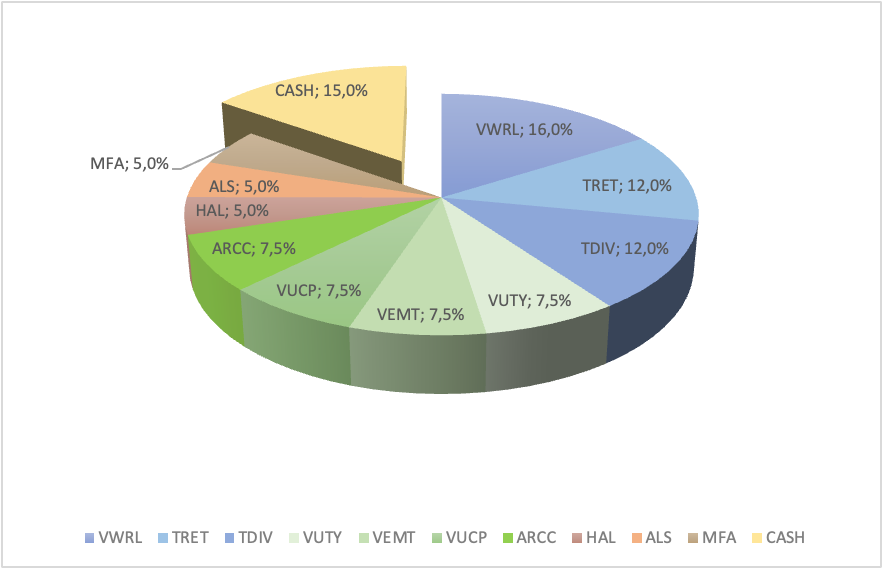

My daughter’s portfolio is humming along quite nicely. Since inception the return has been 22,69 % (4 February 2025) after cost (Start 13 Okt. 2022). I don’t make many adjustments to the portfolio. It is meant as a set it and forget it portfolio, that if someone would be so inclined is easy to replicate in some form or manner (no investment advice).

Now, I did make some small changes to optimize the portfolio.

Target:

Actually:

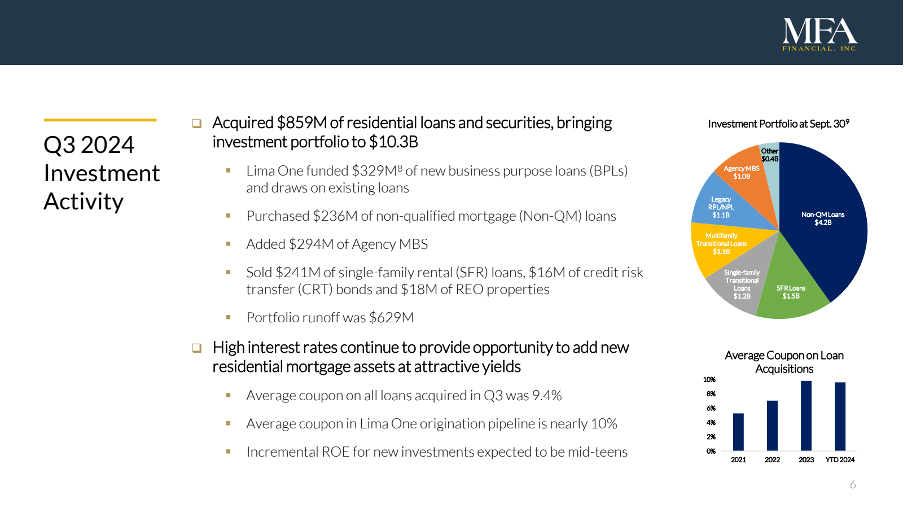

I have added MFA Financial Inc. (MFA), a small-sized mortgage REIT that is specialized in financial solutions in the residential market. It has a market-Cap of ~1 B USD.

Sheet from Q3 2024 results presentation

I wanted to add exposure to a mortgage REIT because I feel they are in a good environment with a steepening yield curve (in the US). I also expect the broad real-estate sector to have a positive upcoming year, this will make the value of their assets grow (in theory). Next to that I feel with rates stable as they are, consumers start to adjust to a higher mortgage rate to finance their home. They have a large dividend ~ 13 % and trade at almost half their book value.

I also moved US treasuries into UK gilts. I expect at some point the USD to come of it’s high. I feel the Trump administration will take actions to move the USD down to a lower level. Moreover, I feel the GBP trades relative flat to the EUR but has still higher carry. Next to that the UK is in my expectations at the onset of a rate cut cycle, this will pressure the GBP but also will make the value of the gilts move up.

10-years chart: EUR/USD pair

10-years chart: EUR/GBP pair

Let’s see what these changes will bring.

That was it for: Looking in Nr. 33.

I hope you enjoyed Nr. 33, please consider signing up for Hugo’s Substack. I can give you already one good reason to do so, it’s for free, what else you want, right?

If you have any comments or questions, please feel free to contact me, please share, like and subscribe. Sincerely,

Hugo Engels.

About the letter:

Dear reader, I’ve decided to start a letter on my investing process. I’m not a professional trader or investor and I hold no licenses or registrations. This letter can never be viewed as investment advice and the expressions and opinions that are written are mainly for entertainment purposes only.

Through this letter I want to evolve my own investment process and maybe give the reader an interesting prospective of a retail trader who enjoys markets and investing. If you are a starting investor who wants to go beyond the passive index fund, buy and hold strategy and would like to construct a more personal portfolio based on fundamentals this could by a nice letter for you to follow. Of course, any other reader would be more than welcome, and I would also love to have feedback. This is first of all a learning process for me.

In this letter I want to give my personal view on markets and investment processes. It will be from a European perspective with a clear value orientated focus. With an extra focus on The Netherlands. Hope you enjoy,

Hugo Engels